As the country continues to experience its biggest cost of living crisis in decades, many people are struggling to keep their heads above water.

Some of the most pressing issues facing our clients were discussed at a recent cost of living live broadcast by Citizens Advice. The session also featured a question and answer session with Martin Lewis, financial journalist, broadcaster and founder of the website MoneySavingExpert.com.

Here some of the key points from the live broadcast

Food bank referrals

By the end of November, nationally Citizens Advice had already helped more than 208,000 people with crisis support including food bank referrals and emergency charitable support. That’s more than we’ve helped at this point in any other year on record and the whole of 2022.

Energy issues and prepayment meters

Sadly, many people can’t afford to top up their prepayment meters. People are sitting in the cold and they’re sitting in the dark! In 2022, we saw a record number of people unable to top up their prepayment meters, and by November 2023, accentuated by rising interest rates affecting mortgage holders, we were already at that level.

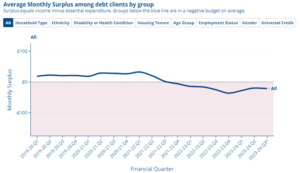

Negative budgets

A negative budget is when a client has more outgoings than incomings each month. Around 50% of clients who come to us for advice about debt, have a negative budget. When we discuss their financial circumstances, we look at their incomings and outgoings to and try and pair them up. If there’s a surplus, it can be used to pay the debt back. However, increasingly we’re seeing people who don’t have a surplus. Indeed, it’s the opposite.

What is causing the debt?

Mortgage holders have experienced a rapid increase in negative budgets over the last 18 months. Social renters have the lowest rate of negative budgets, although still much higher than it was. In the past private renters were way above mortgage holders, but mortgage holders have plunged further and further into negative budgets amongst our client group. They are the deepest in in a negative budget.

Debt types and interconnectedness

As well as mortgage debts, energy and council tax debts have reached alarming figures at £1,800 and £2,000, respectively. The interconnectedness of debts is piling on of problems for our clients with a correlation between different types of debts.

Homelessness

Disabled people are now the majority of people that we see regarding advice about homelessness. That didn’t used to be the case, and we go back 10 years with our monitoring of the issue. And if we look at housing tenure, homelessness is high in the private sector where rents have rapidly been increasing. A rise in homelessness is caused by a rise in Section 21 evictions (commonly known as a ‘no fault possession notice’).

Impact of ‘Buy Now, Pay Later’

We can see an increase of almost 75% in ‘Buy Now, Pay Later’ issues, revealing its association with other debts such as rent arrears, credit card debt, and energy debt. Almost two-thirds have rent arrears, over half have a credit card debt and half have an energy debt.

The questions we asked Martin Lewis

In the same session, Martin Lewis joined Citizens Advice to answer questions.

Hear how Martin responded to our questions (Martin joins us at 30 minutes and 30 seconds):

Energy prices

“With energy prices are still a big worry for people this winter, what can be done by the government and others to help people now? And what do you think of ideas like an energy social tariff to make bills more affordable?”

Social tariffs

“We know that not enough people are claiming social tariff options that exist. So how can we make it easier for people to get social tariffs and also save money on essential bills?”

Negative budgets

“What challenges do negative budgets pose to the advice sector? In general, what could the government be doing to address the problem of negative budgets?”

Local Housing Allowance

“Whilst it’s positive that local housing allowance will be restored to the 30 percentile of market rents before April next year, we know that the LHA may be frozen again in future years. So should the LHA be permanently tied to the 30 percentile of market rents, and what else could be done to make housing more affordable?”

Watch the video of the broadcast

Citizens Advice South West Surrey CONTACT DETAILS

Call Adviceline (free) to speak to an Adviser:

Guildford and Ash 0808 278 7888

Leave online message

Office opening details

And for other topics, check-out our online advice about benefits, money and debt, housing, consumer issues, work problems, and relationships.